The 3D printing market was smeared with red ink earlier this week when Stratasys (NASDAQS: SSYS) pre-announced results that completely underwhelmed the market.

As one who was bullish on Stratasys and the broader 3D printer market, this announcement came as a complete and utter surprise. It wasn’t just that management said 2014 results would come in below expectations. It was also management’s commentary on why results would be light, and how the issues would curb growth in 2015 too.

Many analysts, yours truly included, felt that the hype surrounding 3D printing stocks had died down enough, and market fundamentals made it safe to wade into these stocks again. For the time being, we are dead wrong – at least in the case of Stratasys.

We’ll know more about the broader industry trends when 3D Systems (NYSE: DDD), ExOne Co. (NASDAQ: XONE) and Materialize (NASDAQ: MTLS) have all reported. But those results won’t all be in until mid-March.

In the meantime the focus will remain on Stratasys, and what went wrong.

First, we were expecting that Stratasys’ MakerBot printers would drive the company’s growth in 2014 and 2015. MakerBot is the company’s desktop printer that is aimed at the consumer market. The product has been generating the bulk of growth, more than doubling sales in Q3 2014. It also makes up a significant portion of total sales — at least it did in the third quarter with 18% of total sales.

But Stratasys just announced that MakerBot sales only grew by 7% in the fourth quarter, and only made up 12% of total company sales. While the company invested heavily in MakerBot throughout 2014, the product had quality control and distribution issues that dramatically curbed sales.

The story could get worse. Stratasys is taking a goodwill impairment of $100 million to $110 million on MakerBot in the fourth quarter. And it’s possible there could be more charges in the first half of 2015.

The issues with MakerBot are a major blow to an investment thesis in Stratasys, given the product’s relative importance. Without MakerBot, the company isn’t going to achieve expected growth.

Looking into 2015, Stratasys now expects revenue in the range of $940 million to $960 million. That’s at least $35 million lower than the Street was expecting. And it drops revenue growth to around 25% from nearly 30%. And of course, that growth rate comes off of a lower=than-expected base in 2014.

Profits will be dinged as well since management has said it will increase investments by 2% to try to maintain market share and maintain growth. While the Street was expecting 2015 adjusted EPS of $2.75-$3, management has now guided for $2.07 to $2.24.

And just to add a little more uncertainty, management stated that, “… projected non-GAAP net income is expected to be derived disproportionately from the second half of fiscal 2015…” In other words, the company has to sort out the issues in the first half, then execute in the second half, in order to meet these reduced targets.

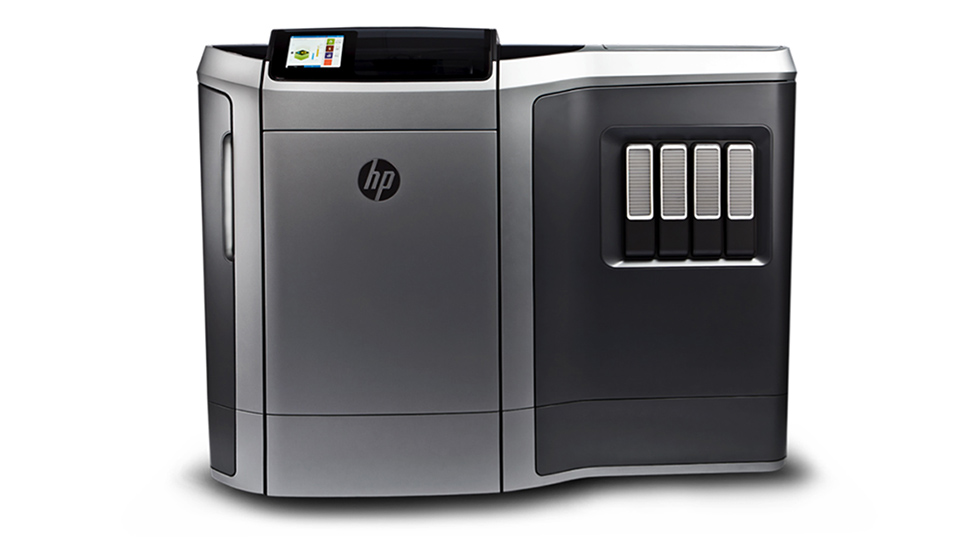

It’s going to take the company some time to get this all sorted out. That pushes out a “return to normalcy” to late 2015. And at that time, the 3D printer market will be largely focused on the impact of Hewlett-Packard’s (NYSE:HPQ) entrance (expected in 2016).

Stratasys has a tough row to hoe when it comes to convincing the market that it’s on track to achieve its annual revenue target of $3 billion by 2020.

Though I was a proponent of the stock even last week, after this announcement I’m not convinced. I expect management has tried to get all the bad news out at once so it can have some potential to surprise to the upside in the future.

But at this point, I suggest investors steer clear of Stratasys until the company restores confidence and gives greater clarity on MakerBot’s future.

Silicon Valley’s Dirty Little Secret

It’s a simple fact. There’s actually one company whose stock rises five times higher than shares of AAPL – every time Apple launches a new iPhone. FIVE. TIMES. HIGHER. It’s the dirty little secret of Silicon Valley – because this company is responsible for keeping every single smart phone running. Without its technology, the iPhone and every other smart device would be rendered useless. That is why savvy tech investors send these shares rocketing five times higher than shares of AAPL every time a new iPhone comes out. Get the whole story. Click here now.

9 thoughts on “Why Stratasys 3D Printer Stock Crashed”

Comments are closed.